I usually start this email by talking about what a wild week we had, but to be honest, I haven’t done much of anything concerning the market lately. I still did my nightly routine all week, but I barely checked in during the day, and I didn’t miss much.

This detachment from the market, while it was open, is a new thing for me, but I have to say that I like it. I think I’m going to start to move my approach in this direction more and more, even after we get a follow-through day and subsequent rally.

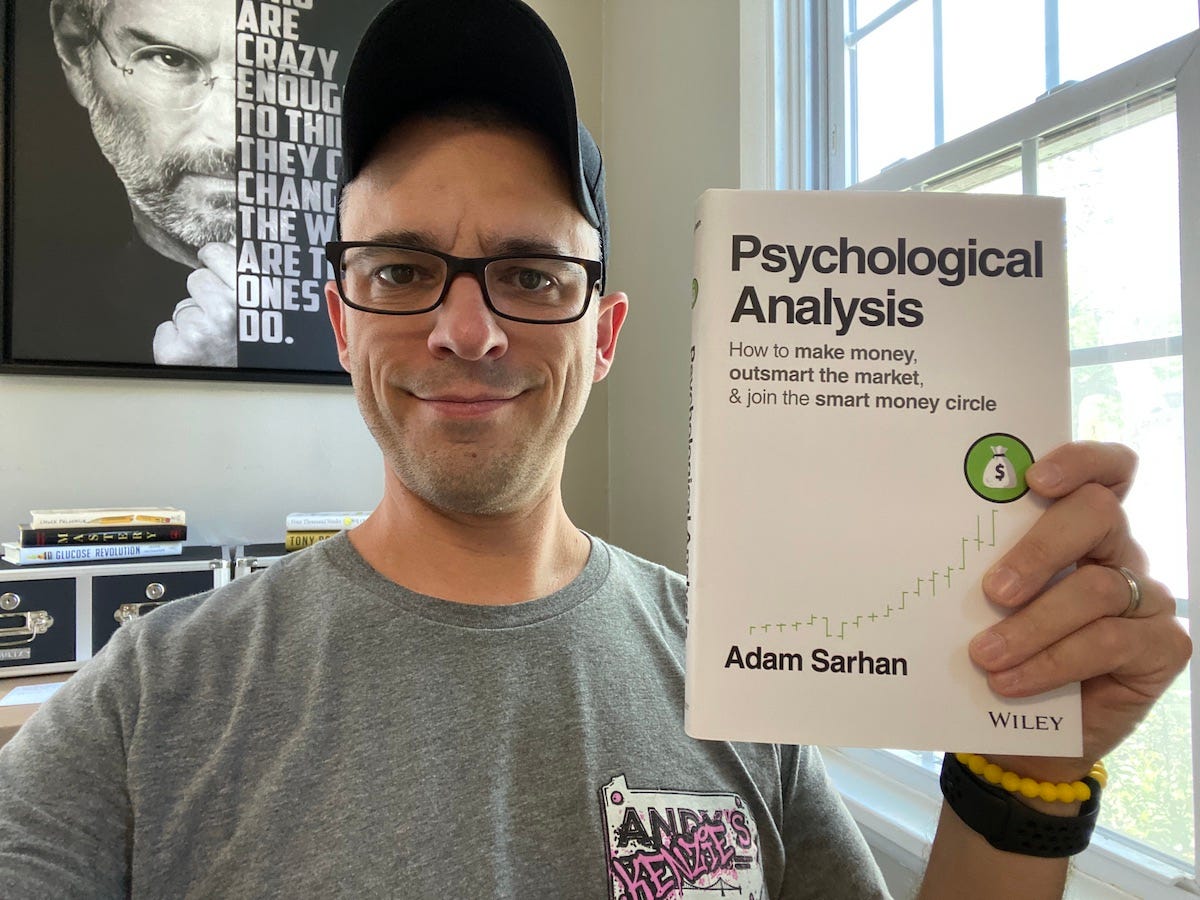

Our book club assignment this week was Chapter 10 of Psychological Analysis by Adam Sarhan, which dug into some of the issues that might be holding you back as a trader. Like everything else in this book, I thought it was well done. Let’s get into the material.

Money is Neutral

Money is neutral. It is neither good nor bad. It exists as a necessary component of a complex civilization. It is a tool, like fire. Fire can be used to cook a hearty meal, or it can be used to burn down a house. Likewise, money can be used to create comfort, security, and opportunity, or it can be used to exploit people, stifle competition, and feed unhealthy/greedy desires. (135)

Sarhan starts off the chapter with an excellent reminder that money is just a tool that can be used to create positive or negative outcomes. He urges us to be cautious to avoid adding our own negative connotations.

I’ve recently discovered that I have some issues in this area. While I might think that I believe these things about money, I struggle with the fact that people around me don’t always agree. I need to get past caring what other people think, but that is much easier said than done.

Use That Capital to Create Value

When you invest money in a good company, the company will use that capital to create value in society, which will stimulate - and grow - the economy, and create more wealth for everyone involved. (136)

Capitalist markets are not zero-sum games. Making a profit from trading does not necessarily mean that someone else must take a loss.

This has always been my approach to business in general. People are often surprised that I encourage customers to check out other restaurants in the area, but it only makes sense that more good restaurants would lead to more people eating out.

It’s interesting to hear this same growth mindset applied to the market, and I think it’s an excellent way to frame our approach to trading.

The Future is Unknown

The future is unknown, and each one of us is either navigating into the unknown or following someone else into the unknown - but nobody knows for sure where we’re headed. (138)

Sarhan argues that the sense of certainty that comes from working at a big company is only an illusion, and that no one knows where we are headed or if any large companies will be more stable than someone betting on themselves.

As someone who skipped the certainty of working for a big corporation right out of college in favor of an opportunity to have a more hands-on role in a small business, I absolutely agree with this idea. I’ve seen plenty of people who took supposedly more secure jobs end up finding out they were not.

No one knows what the future holds. The best we can do is make big bets on ourselves and then work our tails off to put the odds in our favor.

I’ll Be More Motivated to Clean It

Instead of “clean the pool,” consider writing “enjoy the pool this weekend.” If I have the goal of enjoying the pool in mind, I’ll be more motivated to clean it (and do whatever else is necessary to accomplish my goal - which means I will do a lot more than just one mundane task). (139)

Sarhan advocated using a “results list” instead of the standard to-do list will help you establish motivation to get certain things done by focusing on the part where you enjoy the fruits of your labor.

I recently read about a similar concept where you keep a list of things you accomplished instead of things you need to do, but I like this idea even better.

Framing is everything when it comes to getting yourself motivated, and this simple little trick could mean the difference between HAVING to review your stocks at the end of a long day or GETTING the chance to plan your financial future.

Successful People Take Action

Successful people take action, break down their mental walls, find solutions, and get to the next level. Unsuccessful people ignore their shortcomings or create a dumb story where they are victims of an unfair world, a series of unfortunate events - or any other excuse you can think of. (144)

Successful people put in the effort to overcome the obstacles in front of them. Find a way to do the same. Like everything else discussed in this chapter, this is a simple concept that we need to keep top of mind. Let’s work on that this week.

I will remind everyone that I’d like to develop this into more of a conversation. There is a link to leave a comment at the bottom of this email, or you can go to the post page at SubStack, where the comments are open. Let me know which point hits home for your and why, and let’s see if we can’t build something special.

We’re onto Chapter 11 of Psychological Analysis for next week, which is titled “Creating a Smarter You with an Unbiased Mind.” I’ve always been fascinated by biases, so I’m curious to see what Sarhan has to say.

Have a fantastic and profitable week!